Hybrid Line of Credit: Flexible Funding Options from Your Wyoming Credit Union

Wiki Article

Elevate Your Banking Experience With Credit Report Unions

Exploring the world of financial experiences can typically cause uncovering covert gems that provide a rejuvenating departure from traditional banks. Lending institution, with their emphasis on member-centric services and community involvement, provide a compelling choice to conventional banking. By focusing on specific demands and promoting a feeling of belonging within their subscription base, lending institution have taken a niche that reverberates with those looking for an extra personalized strategy to managing their funds. But what establishes them apart in terms of elevating the financial experience? Allow's dive deeper right into the unique advantages that cooperative credit union give the table.Benefits of Cooperative Credit Union

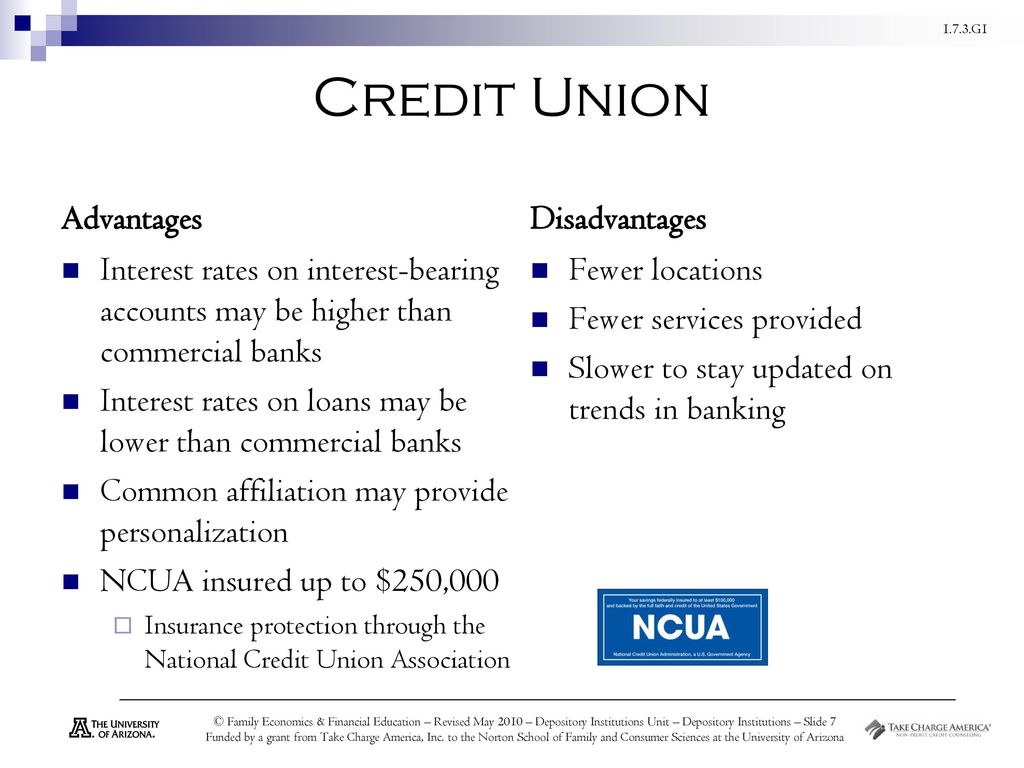

Offering a variety of economic services customized to the demands of their members, cooperative credit union provide many advantages that establish them apart from conventional financial institutions. One vital benefit of credit report unions is their focus on community involvement and member complete satisfaction. Unlike banks, lending institution are not-for-profit organizations possessed by their participants, which commonly brings about decrease charges and much better rates of interest on interest-bearing accounts, fundings, and charge card. Furthermore, credit score unions are understood for their customized consumer service, with personnel putting in the time to comprehend the one-of-a-kind financial goals and challenges of each participant.

An additional advantage of credit score unions is their democratic structure, where each participant has an equivalent enact electing the board of directors. This guarantees that choices are made with the very best interests of the participants in mind, rather than focusing entirely on optimizing earnings. In addition, cooperative credit union often supply economic education and therapy to help participants improve their financial literacy and make informed decisions concerning their cash. Overall, the member-focused strategy of credit report unions establishes them apart as organizations that prioritize the health of their area.

Membership Demands

Some credit scores unions may offer individuals that function or live in a certain geographical area, while others might be affiliated with specific business, unions, or organizations. In addition, household members of current debt union members are frequently eligible to join as well.To come to be a member of a credit history union, people are usually required to open an account and keep a minimal deposit as defined by the establishment. In many cases, there may be one-time subscription fees or recurring membership fees. As soon as the subscription criteria are satisfied, people can take pleasure in the benefits of coming from a credit union, including accessibility to individualized economic services, competitive rate of interest, and a concentrate on member complete satisfaction.

Personalized Financial Services

Personalized financial solutions tailored to private demands and choices are a trademark of credit unions' commitment to participant contentment. Unlike typical financial institutions that typically supply one-size-fits-all services, lending institution take a much more tailored approach to managing their participants' funds. By understanding the distinct goals and situations of each participant, credit rating unions can offer customized recommendations on savings, financial investments, car loans, and various other economic products.Cooperative credit union prioritize constructing solid connections with their participants, which permits them to use tailored services that surpass just the numbers. Whether someone is conserving for a specific objective, preparing for retired life, or aiming to improve their credit rating, cooperative credit union can produce personalized monetary plans to assist members attain their objectives.

Additionally, lending institution typically supply reduced fees and competitive rate of interest prices on finances and financial savings accounts, additionally enhancing the individualized financial services they offer. Cheyenne Credit Unions. By concentrating on specific demands and providing customized remedies, lending institution establish themselves apart as trusted financial partners devoted to aiding participants grow monetarily

Neighborhood Participation and Assistance

Area involvement is a cornerstone of lending institution' mission, mirroring their dedication to sustaining regional initiatives and promoting purposeful connections. Lending institution actively get involved in neighborhood events, enroller regional charities, and arrange economic proficiency programs to educate non-members and participants alike. By buying the communities they offer, credit rating unions not just enhance their relationships but also add to the overall wellness of society.Supporting tiny businesses is an additional means credit score unions show their commitment to local communities. With providing small service loans and monetary recommendations, cooperative credit union assist entrepreneurs prosper and promote economic development in the area. This assistance exceeds just financial support; cooperative credit union typically give mentorship and networking chances to aid small companies prosper.

Moreover, cooperative credit union regularly participate in volunteer work, motivating their workers and members to repay through numerous social work tasks. Whether it's taking part in local clean-up events or arranging food drives, cooperative credit union play an active role in improving the quality of life for those in need. By prioritizing community involvement and assistance, cooperative credit union absolutely symbolize the spirit of participation and common aid.

Online Banking and Mobile Applications

Mobile applications provided by debt unions further boost the financial experience by supplying added flexibility and ease of access. Generally, credit rating unions' on the internet banking and mobile apps empower participants to handle their finances successfully and securely in today's hectic electronic globe.

Conclusion

To conclude, credit rating unions supply an one-of-a-kind financial experience that prioritizes neighborhood involvement, individualized solution, and member satisfaction. With reduced costs, competitive rates of interest, and customized financial services, cooperative credit union cater to private demands and promote monetary well-being. Their democratic framework values member input and supports local communities via numerous initiatives. By signing up with a lending institution, people can boost their financial experience and build strong relationships while appreciating the benefits of a not-for-profit economic establishment.Unlike banks, credit unions are not-for-profit organizations owned by their members, which usually leads to decrease fees and better interest rates on savings accounts, fundings, and credit report cards. In addition, credit report unions are understood for their customized client solution, with staff participants taking the time to recognize the one-of-a-kind monetary goals and difficulties Hybrid Line of Credit of each participant.

Report this wiki page